Applicant information

EAS Frequently Asked Questions

General Questions

Can I apply for EAS based on the impact of COVID-19?�

Applicants whose most recent study was negatively impacted by COVID-19 can apply for the Educational Access Scheme.

Each applicant must make a case based on their individual circumstances and supply all the supporting documents normally required for the category in which they are applying.

Some examples of COVID-19-related circumstances we have considered in past admissions years are supplied below.

EAS Category | Circumstances |

School Environment | Positive COVID-19 case/s in school community leading to prolonged school closure. Poor internet connectivity for rural and regional students negatively impacting online learning during protracted COVID-19 lockdowns. Missed schooling Boarding students forced to return home to remote areas and unable to recommence in-person studies at the same time as city peers due to travel restrictions and lockdowns. Returned overseas travellers who missed a significant period of study due to quarantine requirements. |

Home Environment | COVID-19 case/s in applicant’s immediate family or household disrupting study for a significant period. Family members of front-line health care workers who experienced serious disruption to their home environment. |

Personal Illness | Applicant tested positive to COVID-19 with severe and prolonged impact on study. Disabled applicants and applicants with learning difficulties whose conditions affected their ability to participate in online study during prolonged lockdowns. |

My family or school was impacted by the recent floods. Can I apply for EAS?�

QTAC encourages flood-affected applicants to apply for the Educational Access Scheme when their most recent study was negatively impacted.

Apply in the Financial Hardship category if your household has experienced financial difficulties as a result of the floods.

Apply in the Home Environment and Responsibilities category if your home was damaged.

Apply in the School Environment category if your schooling was disrupted.

Where can I download the EAS Cover Sheets?

Find the cover sheets on the EAS page, under EAS Categories & Coversheet Downloads section.

If I’m eligible for EAS, does this mean my ATAR will change?

No, institutions adjust your selection rank for a particular preference or course; your ATAR does not change.

What documentation do I provide for EAS?

Documentation required for EAS depends on the EAS category you apply under. For most categories, you must complete the relevant Educational Access Scheme cover sheet and attach supporting documentation. View the EAS Categories for specific documentation requirements.

Can I upload my EAS supporting documents as multiple files?

Where possible, please upload one high-quality PDF file per EAS category, containing all supporting documents. You won’t be able to upload more than one file.

However, you can always provide additional documents by emailing them to documents@qtac.edu.au.

Are there any equity scholarships linked to EAS?

Most institutions offer scholarships, including equity scholarships that assist regional students, Aboriginal and/or Torres Strait Islander students, and students from low-income backgrounds access study.

You must apply to the institution directly for most scholarships, except: QUT’s Q-Step Scheme, UQ’s UQ-Link Program, and the USC Equity Bursary. For these scholarships, apply for the Financial Hardship category of our Educational Access Scheme in your QTAC application.

Is applying for the Educational Access Scheme (EAS) mandatory?

No, EAS is an optional part of your application. If you decide you no longer wish to apply for the scheme, you should notify QTAC as soon as possible. You can do this by uploading a note to your application stating you no longer wish to apply or by calling our contact centre on 1300 467 822.

How much educational adjustment can I get?

QTAC’s participating tertiary institutions each have their own rules about the maximum EAS adjustments they allow, as well as how EAS is weighted and combined with other adjustments.

For more information, check directly with your preferred institutions or call QTAC’s contact centre on 1300 467 822.

Do all QTAC institutions accept EAS?

The following institutions do not accept EAS for any of their courses:

- Bond University

- SAE Institute

- Torrens University

- Griffith College

If you are applying to one of these institutions but also selected preferences at others, you may still wish to apply for EAS. Any educational adjustment will only be applied to your preferences at participating institutions.

If your only nominated institutions do not accept EAS, you may wish to cancel your EAS application or change your preferences.

Are there any courses that do not accept EAS?

EAS is not accepted for the courses listed below. If you are applying to one of these courses but also preferenced others, you may still wish to apply for EAS. Any educational adjustment will only be applied to courses that accept the scheme.

If your only nominated courses do not accept EAS, you may wish to cancel your EAS application or change your preferences.

Institution | Course |

Bond University | Bachelor of Medical Studies programs |

CQUniversity | Bachelor of Education programs |

Griffith University | Medical Science, Bachelor of Laws (Graduate Entry), Dental Health Science, Master of Teaching programs, all Nursing Advanced Standing programs, Bachelor of Animation, Bachelor of Film and Screen Media Production, Bachelor of Games Design |

James Cook University | MBBS Bachelor of Medicine-Bachelor of Surgery, Bachelor of Dental Surgery, Bachelor of Veterinary Science |

Queensland University of Technology | Dean’s Scholar’s Programs; Academic Scholarship courses; all courses with audition, portfolio, or interview requirements |

What happens after I apply for EAS?

Once you have finalised your application and given QTAC all the required supporting documents, our EAS assessors will consider your case against specialised criteria in the five categories.

If our assessors require more supporting evidence, they will contact you and ask for it. Please take care when supplying additional documents. Our assessors only have time to write to you once.

Your EAS application can only be finalised once you have supplied all requested documents.

If your application is successful an educational adjustment will be applied to your selection rank.

Have my EAS documents been assessed yet? When will my EAS application be assessed?

QTAC receives a large number of EAS applications every year.

During the peak period in November and December, we are often processing applications submitted two to three weeks ago. Please wait a fortnight before inquiring.

Ensure you read documentation guidelines closely and supply correct documents. If we need to send you correspondence requesting additional documents, this can delay processing.

Did you receive my EAS documents?

If unsure, check applicant online services. At busy times, it may take an assessor two to three weeks to look at your application.

What documents have I provided?

For your own reference, please keep copies of all the EAS documents you submit. You can upload additional documents at any time if you realise you have forgotten something.

Are the documents I supplied sufficient?

If the documents you supplied do not meet our requirements, an EAS assessor will send you correspondence. The correspondence will advise why the current documents are insufficient and what further documents are required. Please regularly monitor QTAC online services for EAS correspondence.

If you have not received correspondence specifically requesting additional EAS documents, then you can assume our assessors have not yet looked at your case.

I received correspondence requesting further EAS documents. What do I need to provide?

Read the correspondence carefully. Our assessors will list everything they need you to send. You should also check what you have supplied against the general documentation guidelines on our website. You can only be considered for an adjustment if you supply all required documents.

My school said they will supply my supporting documents directly to QTAC. Have you received them yet?

Check with your school initially. If we have not received documents from them by the time an EAS assessor looks at your case, we will send you correspondence advising that the School Statement remains outstanding.

What was the outcome of my EAS application?

You will be advised via applicant online services when assessment of your EAS application has been finalised. If you require more information, please call or email the QTAC contact centre on 1300 467 822.

What should I do if I disagree with the outcome of my EAS application?

First, re-read the eligibility and documentation guidelines in your chosen EAS categories. If you still believe your case has not been fairly assessed, please set out the reasons in writing and submit to QTAC requesting a formal review. You may also wish to provide any additional documents you feel will support your case.

Can I supply my EAS documents from a previous application?

We assess all EAS documents that are supplied to us on a case-by-case basis. Up-to-date supporting documents usually provide the best evidence of the disadvantage you experienced during your most recent study.

In some instances, if the affected study took place in the past and you have not undertaken any study since, older documents may provide all the information we need.

I cannot supply supporting documents. Can I still be considered for EAS?

EAS is an evidence-based scheme. We cannot apply an educational adjustment unless sufficient supporting documents are supplied.

I no longer wish to apply for EAS. What should I do?

Please upload a note against each EAS category in your application stating that you no longer wish to apply.

Which courses count as bridging or preparatory studies courses?

Not sure if you are taking a bridging and preparatory studies courses? Refer to the list below:

Australian Maritime College Preparation Programs

Australian National University Preparation Programs

Bond University Foundation Programs

Charles Darwin University Preparation Programs

Canberra Institute of Technology Preparation Programs

Central Queensland University Preparation Programs

Charles Sturt University Preparation Programs

Curtin University of Technology Preparation Programs

Deakin University Preparation Programs

Edith Cowan University Preparation Programs

Flinders University Preparation Programs

Griffith University Preparation Programs

James Cook University Preparation Programs

La Trobe University Preparation Programs

Monash University Preparation Programs

University of Newcastle Preparation Programs

University of New England Preparation Programs

NSW TAFE Cert III/IV in Tertiary Preparation

Other bridging or preparatory studies course

Queensland Conservatorium of Music Preparatory Program

TAFE QLD Certificate in Engineering Preparatory Studies (CN649, CNJ30)

QLD Certificate IV in Adult Tertiary Preparation

Queensland University of Technology Preparation and Bridging Programs

RMIT Preparation Programs

University of South Australia Preparation Programs

University of the Sunshine Coast Preparation Programs

Swinburne Institute of Technology Preparatory Programs

University of Southern Queensland Preparation Programs

Southern Cross University Preparation Programs

University of Tasmania Preparation Programs

University of Adelaide Preparation Programs

University of Ballarat Preparation Programs

University of Canberra Preparation Programs

University of Melbourne Preparation Programs

University of New South Wales Preparation Programs

University of Queensland Preparation Programs

University of Sydney Preparation Programs

University of Technology, Sydney Preparation Program

University of Wollongong Preparation Programs

Victoria University Preparation Programs

University of Western Australia Preparation Programs

University of Western Sydney Preparation Programs (all campuses)

UNILEARN Bridging subjects

Financial Hardship

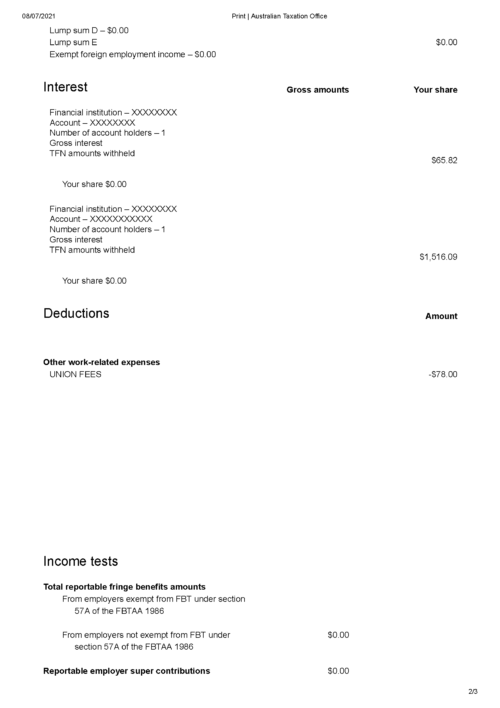

What Supporting documents do I need to supply for Financial Hardship?

All financial hardship applicants – except for those whose Centrelink benefits we can verify electronically – must supply a completed financial hardship coversheet. This is needed to establish household composition and financial circumstances.

Financial hardship is assessed based on your gross household income. The supporting documents you need to provide depend on whether you are:

- Dependent (21 or younger)

- Independent (21 or younger)

- Independent (22+ and on the maximum rate of a benefit)

- Independent (22+ not on maximum benefit)

- Partnered

- A Business Owner or Dependent of a Business Owner

- Below Tax-Free Threshold

Dependent (21 or younger)

If you are 21 or younger, you are considered dependent unless you meet one of the conditions that make you independent (21 or younger).

We require evidence of your parents/guardians’ income, even if you are earning income yourself.

If your parents or guardians only income is a Centrelink income and asset tested benefit, you must supply:

- Your parents’ or guardians’ most recent Income Statement from Centrelink

If your parents or guardians receive income other than a Centrelink benefit, you must supply:

- Your parents’ or guardians’ Income Tax Return for the most recent financial year

- Your parents’ or guardians’ Notice of Assessment for the most recent financial year

Independent (21 or younger)

If you’re 21 or younger, you can be considered independent if any of the following apply. You:

- can show you support yourself through work

- are, or have been, married or are in a registered relationship

- live in a de facto relationship as a member of a couple for at least 12 months

- have, or have had, a dependent child

- are a job seeker assessed as unable to work over 30 hours a week

- are in a situation where it’s unreasonable to live at home

- have parents who can’t look after you

- are a refugee and your parents don’t live in Australia

- are an orphan and haven’t been legally adopted

- are in state care, including foster care.

See documentation guidelines for Independent (22+ and on the maximum rate of a benefit) or Independent (22+ not on maximum benefit) whichever applies to you.

Independent (22+ and on the maximum rate of a benefit)

If you are 22 or older Centrelink considers you independent.

If you personally receive the maximum rate of a Centrelink income and asset tested benefit, simply enter your Centrelink Customer Reference Number (CRN) in the QTAC application.

QTAC will confirm your information with Centrelink electronically.

Independent (22+ and not on the maximum rate of a benefit)

If you are 22 or older Centrelink considers you independent.

If you don’t receive the maximum rate of an eligible Centrelink benefit, you must supply:

- your Income Tax Return for the most recent financial year

- your Notice of Assessment for the most recent financial year

- your most recent Income Statement from Centrelink (if you receive benefits)

Partnered

If you have a partner, you must document gross income for both you and your partner.

To document your gross income please supply:

- your Income Tax Return for the most recent financial year

- your Notice of Assessment for the most recent financial year

- your most recent Income Statement from Centrelink (if you receive benefits)

To document your partner’s gross income please supply:

- your partner’s Income Tax Return for the most recent financial year

- your partner’s most recent Income Statement from Centrelink (if they receive a benefit)

- your partner’s Notice of Assessment for the most recent financial year

A Business Owner or Dependent of a Business Owner

Business owners and their dependents must fully document their gross business income and expenses as well as individual income.

Sole traders and their dependents must supply:

- the business operator’s individual Income Tax Return

Business operators who run a partnership, company, or trust should supply their individual tax return AND relevant evidence of business income, which may include:

- Business Accounts including a complete, itemised list of expenses

- Partnership Tax Returns

- Company Tax Accounts

- Trust Tax Return

Below the tax-free threshold

If any member of your household aged 22 or older was not required to lodge an Income Tax Return because their income was below the tax-free threshold, you must provide an official non-lodgment advice from the Australian Taxation Office for that person.

QTAC also requires documentary evidence of all income the individual earned below the threshold.

See the table below for guidance on how to document income below the tax-free threshold.

Type of Income | Evidence |

Centrelink Benefit | Annual Centrelink pay summary showing total benefits for the financial year |

Wages | ATO income statements showing gross payments from all employers |

Bank interest | bank statements showing annual interest earned

|

Investment returns | dividend statements |

rent | Income Tax Return required |

What counts as gross household income?

Gross household income includes:

- gross salary and wages from employment

- Centrelink taxed benefits/payments

- employer reportable super and employer reportable fringe benefits

- gross income from a business/primary production

- income from partnerships/trusts

- gross interest earned (refer to Centrelink for the deeming rules)

- gross dividends received (refer to Centrelink for the deeming rules)

- gross rental income from investment properties

- capital gains income

- tax-free payments from Centrelink and

- Department of Veterans’ Affairs payments

What are the institution-determined thresholds for financial hardship?

We calculate eligibility under Financial Hardship based on gross household income from all sources. The figures below are indicative only and subject to change.

If your household income is slightly higher (within 10%), it is still worth applying, as other factors can be taken into consideration.

Status | Weekly Gross Income | Annual Gross Income |

Single, no children | $1,053 | $54,756 |

Couple combined, no children | $1,806 | $93,912 |

Single, one dependent child | $1,806 | $93,912 |

Couple, one dependent child | $1,857 | $96,564 |

For each additional child | $51 | $2,652 |

What if my financial situation recently changed due to extreme circumstances?

If you or your family have experienced extreme financial situations such as early payout of super for medical reasons, please submit supporting documentation in addition to the Income Tax Return, Notice of Assessment and Centrelink documents requested. We assess such situations case by case.

I have supplied all the required documentation for financial hardship. Why have I been asked for additional evidence?

Re-read all correspondence from QTAC carefully and double check the documentation guidelines to be absolutely sure you have supplied full and complete documentation.

Sometimes when applicants claim to be living on very low annual income (less than the maximum of JobSeeker payment) we request further evidence. All claims to be living on income below this level must be substantiated.

I have been asked to supply a copy of my most recent Income Statement from Centrelink. Where can I find it?

Refer to our quick guide.

Which document is the Centrelink Income Statement?

The document we require is clearly labelled “Income Statement.” We need it to check the name and date of birth of the person receiving the benefit, the name of the benefit, and whether the individual is receiving the maximum rate (yes or no).

No other document provides all this information. Be sure not to confuse your Income Statement with a similar looking document titled, “About your Family Tax Benefit/Youth Allowance/Disability Support Pension.”

This document does not provide us with all the information we need and is not assessable.

Why does QTAC require the Income Tax Return and Notice of Assessment for EAS? Why can’t you accept pay summaries or ATO tax summaries?

We calculate eligibility under Financial Hardship based on gross household income. The Income Tax Return is the only document that provides us with all the information needed for our assessment.

We need the Notice of Assessment in addition to the full Income Tax Return as evidence the document was formally lodged with the Australian Taxation Office.

Pay summaries are not assessable as they usually only show income from one employer.

ATO tax summaries are not assessable as they do not show full details of income from all sources.

The Notice of Assessment is not assessable alone without its accompanying Income Tax Return because it shows taxable income only.

What is the difference between an Income Tax Return and a Notice of Assessment?

The Income Tax Return is the longer, multi-page document a taxpayer or their accountant lodges with the Australian Taxation Office.

The Notice of Assessment is the shorter, one-to-two-page document that the Australian Tax Office sends back to the taxpayer once assessment has been finalised.

Both are required for us to assess your eligibility for EAS Financial Hardship.

What documents cannot be used as evidence in the Financial Hardship category?

PayG Payment summaries and ATO Income Statements cannot be used as evidence of financial hardship. They show gross payments from one or more employers, but do not include other kinds of income such as Centrelink benefits, interest, investments, and rent.

Screenshots from the ATO website cannot be used as evidence of financial hardship. These provide an incomplete, unofficial, point-in-time summary of tax information. We require a full Income Tax Return that has been officially lodged with the Australian Taxation Office and its accompanying Notice of Assessment.

Bank statements cannot be used as evidence of financial hardship. They show income and expenses for one or more bank accounts over a period of time, but do not provide an overall picture of an individual’s finances for the past financial year.

My household uses a tax agent and will not lodge a tax return until after the deadline for QTAC applications. Can I apply for Financial Hardship?

If you wish to be considered for EAS Financial Hardship, you will need to lodge you Income Tax Return and have it assessed in time for your QTAC application. You cannot be made eligible without supplying this document.

How do I know if I’ve been offered an institution scholarship?

If you have been made eligible for scholarship the offering institution will contact you directly.

Home Environment & Responsibilities

My past studies were impacted by a difficult home environment many years ago. What evidence can I provide?

An EAS adjustment can only be applied if the circumstances impacted your most recent rankable study.

EAS cannot help if:

- you dropped out of the study without receiving a rank

- If you have undertaken subsequent rankable study

If your most recent study took place many years ago, you may be eligible, but it can be challenging to document your claim.

If you have discussed your past home environment with a psychologist/psychiatrist or other medical professional, they may be able to provide a support letter.

If you have a current diagnosis of a disability or mental health condition related to your past home environment, such as Post Traumatic Stress Disorder, you can supply medical documents as evidence.

Personal Illness & Disability

Can I provide a medical report, letter or certificate from a medical professional instead of having them fill out the patient statement?

The patient statement is the best option as it is up-to-date and supplies our assessors with all the information they require. But we assess all the documents we are given.

If your medical professional would prefer to supply a support letter, please ensure they answer all the questions covered by the patient statement. Otherwise, we may need to write to you requesting clarification.

Only send other medical documents such as referral letters, specialist medical reports, and discharge summaries as a last resort. These do not usually address the impact on study and rarely provide all the information we require.

School Environment

Can I apply for an EAS adjustment based on excessive travel time to and from school?

Yes, but your residential address must be in a regional or remote area. That means it must be in an RA3, RA4, or RA5 area according to the Australian Statistical Geography Standard. You can enter your address and check your eligibility here.

For you to be considered, your daily travel time by car or public transport must be in excess of two hours as a round trip.

If your home address is in an RA1 or RA2 area, you are not eligible for an adjustment based on travel time.

A school peer or teacher died during my senior studies. Can I apply for EAS?

Yes, if the loss of the individual negatively impacted your studies, you can apply in the School Environment category. The personal and school statements should address:

- The nature of your relationship with the person

- When they died

- How long you knew them

- Your involvement in the funeral or other commemorations

- How your studies were impacted

I’m applying on the basis of excessive teacher changes. What information do you need?

We need to know:

- which subjects were impacted

- the number of teachers for each subject

- number of changes for each subject

- why you believe the changes had a negative impact on your studies

For Guidance Officers

Can I send a blanket statement for a group of students who were all impacted by the same circumstances?

Individual support statements usually make a stronger case for the applicant than generic letters. However, we understand that many school staff support a substantial number of EAS applications each year and that considerable time and effort is involved.

All School Statements are read and assessed against the same criteria – including blanket statements. Adding a sentence or a short paragraph describing the educational impact on the individual applicant often greatly improves their chances of receiving an adjustment.

I’m supporting a student who experienced excessive teacher changes. What information do you need?

We need to know:

- which subjects were impacted

- the number of teachers for each subject

- number of changes for each subject

- why you believe the changes had a negative impact on their studies

An EAS applicant has requested my support but would prefer not to disclose the details of their case for privacy reasons. Can I still complete a school statement?

Yes. You can explain in the statement that the applicant has chosen not to inform you of the circumstances for privacy or other reasons.

If appropriate, you can supply other relevant information that may be available to you, such as the number of days of schooling the applicant missed in years eleven and twelve and details of any educational adjustments made at school level.

Ensure the applicant understands that if they wish to be considered for an adjustment, they must:

- disclose the circumstances to QTAC’s EAS assessors in their personal statement

- provide adequate supporting documentation to corroborate the circumstances

If the school statement is the only evidence they supply but it does not specifically confirm the key details of their claim, they will not be eligible for an adjustment.

I have a sensitive case that I want to discuss with a QTAC EAS assessor. How can I get in touch?�

The EAS team are happy to help. You can email us your query via eas@qtac.edu.au or request a call back by providing your name, position, school, and best contact details.

Can QTAC report the outcomes of an EAS assessment to the school?�

The outcomes of an individual EAS assessment cannot be disclosed to anyone other than the applicant or their authorised person. Summary data of EAS outcomes for your whole school is available upon request. Email eas@qtac.edu.au to request.